The oil and gas industry plays a central role in the global energy system, but it also operates in environments with extremely high safety risks. Flammable substances such as crude oil, natural gas, naphtha, and hydrogen are commonly present throughout the production, processing, storage, and transportation processes, resulting in a constant risk of forming explosive atmospheres when these substances mix with air in the presence of an ignition source. Hence, much of the industry’s operational environment is classified as hazardous areas, where equipment must meet stringent explosion protection requirements.

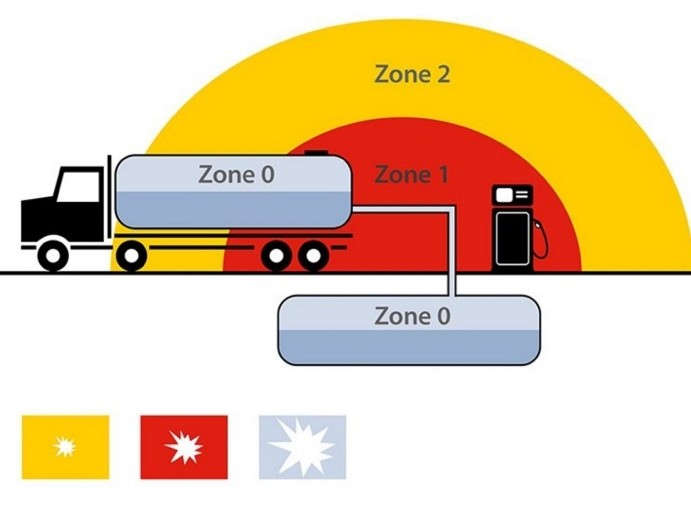

To more effectively manage explosion risks, hazardous areas are categorized based on the frequency and duration of explosive gas atmospheres. The most common classifications are:

Each zone requires equipment with different levels of explosion protection, known as Equipment Protection Levels (EPL). For example, devices used in Zone 1 must meet Ga or Gb protection levels, while Zone 2 allows for Gc-rated equipment.

The oil and gas industry demands strict explosion protection for all electrical and mechanical equipment used in hazardous areas. Equipment deployed in these environments must comply with internationally recognized certification systems, namely IECEx and ATEX.

o ATEX 2014/34/EU (Equipment Directive): Regulates the design and application of equipment and protective systems in potentially explosive atmospheres.

o ATEX 1999/92/EC (Workplace Directive): Specifies minimum safety and health requirements for workplaces in explosive environments.

Both IECEx and ATEX use standardized symbols and alphanumeric codes to classify explosion risk levels, equipment categories, and intended use environments. These codes help industries ensure proper selection, installation, and safe operation of equipment in defined zones.

In the oil and gas sector, hazardous area classification and compliance with IECEx/ATEX standards are not merely regulatory obligations—they are critical for ensuring intrinsic safety, operational stability, and the protection of human life. Any electrical device operating in a Zone 1 or Zone 2 environment must be certified for explosion protection. Equipment built to meet IECEx or ATEX standards forms the foundation for safe, reliable operations in some of the world’s most dangerous industrial settings. If you have any questions, please consult gerchamp, and we will do our best to assist you.

Root Causes of the Crisis: Soaring Power Demand and Aging Grid

In recent years, U.S. residential electricity prices have continued to climb. In 2024, the median residential rate reached 17.47 cents per kWh, with some states experiencing increases exceeding 30%. Two primary factors contribute to this situation. First, natural gas accounts for 43% of the U.S. electricity generation, and fluctuations in natural gas prices are directly reflected in retail electricity prices, resulting in unstable electricity prices. Second, the power grid infrastructure is severely aging—about 70% of transmission lines have been in operation for over 25 years—hindering the system’s ability to meet rising demand and to efficiently integrate clean energy sources such as solar and wind.

Great Potential for Solar Power, but Numerous Obstacles

Despite the power crisis, the U.S. solar PV industry holds tremendous potential for development. From a cost perspective, the U.S. photovoltaic power costs have fallen significantly to 30-40 USD/MWh, even as low as 25 USD/MWh in areas with sufficient light, which makes it economically competitive compared to traditional energy sources. Moreover, solar PV projects have relatively short construction cycles, enabling rapid deployment to mitigate supply-demand tensions.

However, the development of U.S. solar PV faces several challenges. Policy uncertainties and regulatory changes—such as revised approval processes—have created hurdles for project implementation. Supply chain disruptions also constrain growth. Moreover, land use policies limit large-scale solar deployment; some regions oppose installing solar farms on productive farmland, further complicating expansion efforts.

Strategic value and irreplaceability of energy storage

In contrast to the obstacles facing solar PV, energy storage is emerging as an integral part of the U.S. power system. By the end of 2024, the installed capacity of electrochemical energy storage in the US will have exceeded 20GW/50GWh, with an annual growth rate of more than 30%. The rapid development of energy storage is attributed to its irreplaceable practical value:

– Essential Need for Grid Peak Shaving: Energy storage provides millisecond-level response, alleviating the intermittency issues of solar and wind power and compensating for the aging grid’s limited regulation capabilities.

– Support for High-End Manufacturing: Industries such as semiconductor factories require stable voltage and a 24/7 uninterrupted power supply. Energy storage combined with renewable energy in off-grid models can bypass transmission bottlenecks and directly supply power.

– Cost Competitiveness: The levelized cost of electricity of integrated solar PV and storage systems in the U.S. has dropped to 60-90 USD/MWh, close to that of new natural gas power plants (50-80 USD/MWh) and significantly lower than coal power (80-120 USD/MWh).

– Faster Deployment: Solar-storage power plants can be grid-connected within one year, compared to 4-6 years for natural gas plants.

To resolve the U.S. power crisis, it is crucial to promote the synergistic development of innovative energy technologies like solar PV and energy storage. While the solar industry holds tremendous potential, it currently faces policy, land, and supply chain hurdles. Meanwhile, energy storage technology is playing an increasingly important role in the power system due to its advantages in grid regulation, support for high-end manufacturing, cost-effectiveness, and shorter construction cycles. How the U.S. power market balances these factors to promote the healthy development of the solar and storage industries—and thereby alleviate the power crisis—will be worth watching closely in the future.