EMS: The Undisputed Core of Revenue Generation in European Energy Storage

Driven by Europe’s “Carbon Neutrality by 2050” goal, Battery Energy Storage Systems (BESS) have evolved from being “auxiliary equipment” in the energy system to a core pillar. The Energy Management System (EMS), serving as the “intelligent brain” of energy storage, is becoming the critical variable determining a project’s profitability. Whether it’s capturing arbitrage opportunities from electricity price fluctuations, optimizing the efficiency of solar-storage synergy, or mitigating safety and compliance risks, the EMS is integral to the entire commercial chain of European energy storage. It is the core engine enabling companies to break through in a competitive landscape.

Complex Markets Require an Intelligent “Brain”

Europe, particularly Germany, has created abundant profitability scenarios for energy storage through policy and market design. However, realizing all these scenarios depends heavily on the intelligent decision-making of the EMS.

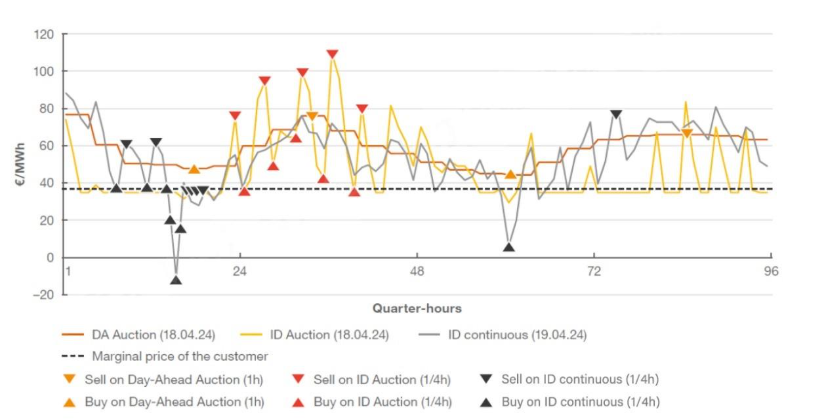

- Dynamic Electricity Prices and Market Opportunities: Germany’s mandatory rollout of dynamic electricity prices starting in 2025 means power prices will fluctuate significantly throughout the day. Simultaneously, intraday price changes in the spot electricity market, the second- or minute-level response demands of the balancing market, and the increasingly frequent occurrence of negative electricity prices collectively form a complex trading environment full of both opportunities and risks.

- A Prerequisite for Profitability Models: The core profit models for energy storage—”charge low, discharge high” energy arbitrage, participation in grid ancillary services, and solar-storage co-optimization—all require real-time analysis of massive data (electricity prices, weather, grid status, battery health) to make millisecond-level optimal decisions. Manual operation is no longer feasible here; automated, intelligent dispatch is the only solution.

This is precisely where the value of the EMS lies: it transforms a passive storage device into an active market participant capable of autonomously seeking the highest returns.

How Does the EMS Act as the “Chief Revenue Officer”?

The EMS directly controls the revenue lifeline of the energy storage system through three core capabilities:

- Multi-source Data Integration and Intelligent Forecasting The EMS is the “nerve center” for energy storage. It collects and analyzes data in real-time from external markets (price forecasts), the grid (dispatch instructions), the generation side (solar/wind power forecasts), and internal systems (battery status). This panoramic view enables it to foresee trends, laying the foundation for developing advanced strategies that go beyond simple peak-valley arbitrage.

- Revenue-Maximizing Strategy and Real-time Control

This is key to the EMS converting data into money. Its built-in advanced algorithm models enable dynamic gaming across multiple markets based on preset business objectives (e.g., profit maximization):

– Precision Arbitrage: It not only decides when to charge and discharge but also accurately captures brief negative price windows, achieving “revenue from charging.” – Multi-market Trade-offs: While engaging in day-ahead market arbitrage, it stays ready to respond to high-value, high-timeliness instructions from the balancing market, intelligently switching and trading eoff between multiple revenue streams. – Co-optimization: For “solar + storage” projects, the EMS makes holistic decisions to maximize the consumption of solar PV generation (avoiding curtailment) while scheduling battery discharge during the most economically beneficial periods, achieving optimal overall returns.

- Aggregation and Connectivity, Unlocking a “Second Income Stream”

The EMS is the “gateway” connecting the storage system to a broader world. Through a unified aggregation dispatch interface, dispersed individual storage units can be “marshaled” by the EMS to form a powerful Virtual Power Plant (VPP). This allows participation in grid frequency regulation, demand response, and other ancillary services, thereby creating stable additional income beyond energy arbitrage.

Outlook: EMS Capability as the Key Competitive Differentiator

As competition in the European energy storage market intensifies and equipment becomes increasingly homogenized, the final Return on Investment (ROI) of projects will depend more and more on their operational efficiency, which is directly determined by the capability of the EMS. In the future, EMS platforms with higher algorithm accuracy, faster response speeds, and more flexible, diverse strategies will be key for asset owners to stand out in the fierce market.